6

Between rent, groceries, fuel, and other expenses, it’s easy to look up and

wonder where your money went. Whether you're living off ramen noodles,

saving for your child’s education, or preparing for retirement, Mint could be

your answer.

Mint is a free, secure app that can help you

manage your spending by setting budgets, providing

your credit score, and automatically categorizing

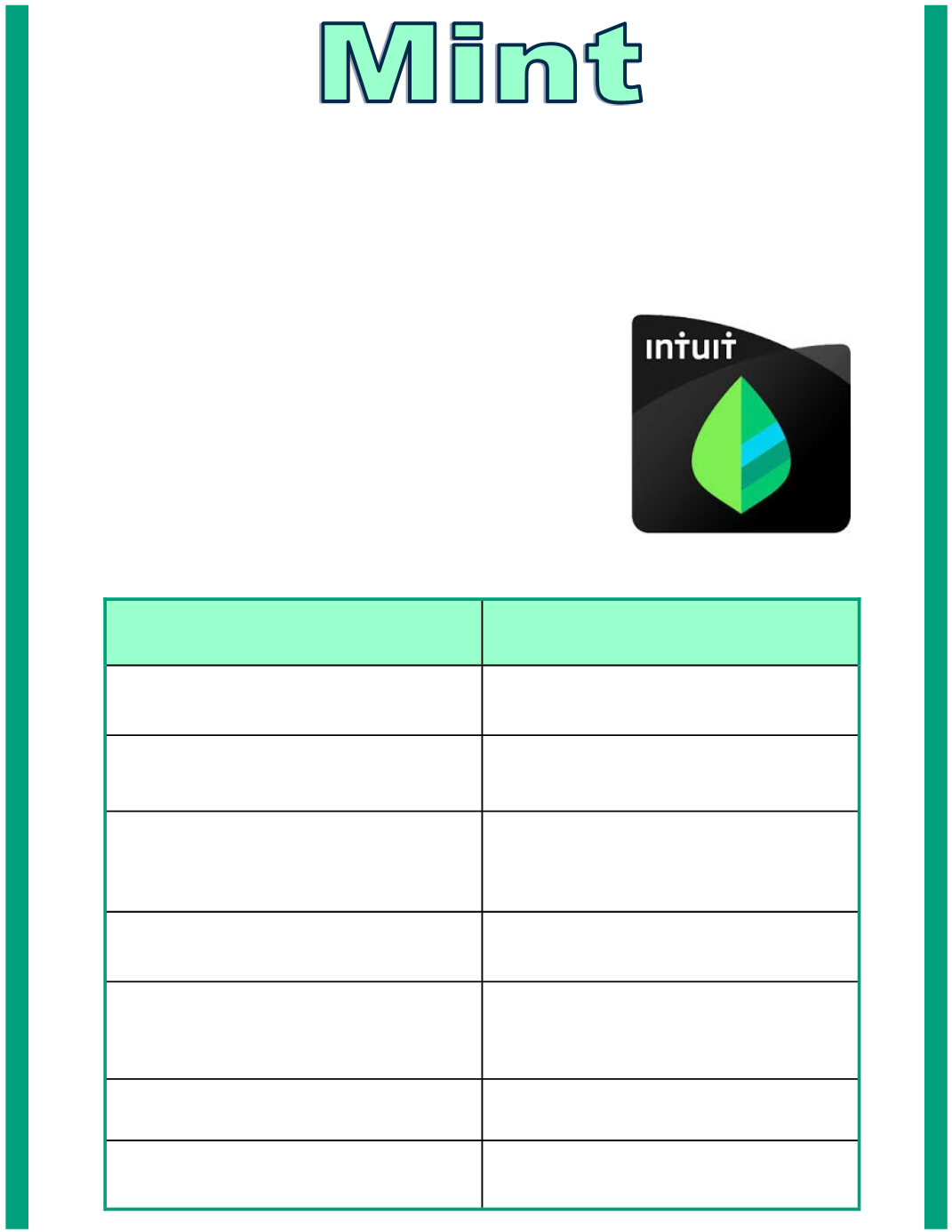

transactions. You can view pros and cons of this in

the table below.

Mint came out in 2012 and is helping over

20 million users. It is available in all app stores and

online at

mint.com.

~ Hannah Moss, Student

Pros:

Cons:

FREE

Complicated if you are splitting bills

with someone else

Automatic account/ transactions

syncing

Misleading positive budget even

when money is in the negatives

Keeps all accounts (checking,

savings) in one convenient place

No way to track cash expenses

automatically/category for it on

budget

Available on IOS, Android, Windows

phone, online, and Amazon

Phone support not available

Send alerts for upcoming bill

payments and other information

Some categorizations need to be

manually changed for some

expenses

Security features

Ads

Shows expenses/spending in labeled

pie chart

Need Internet access to add any

changes

They say money talks…does yours say goodbye?